Customer Services

Copyright © 2025 Desertcart Holdings Limited

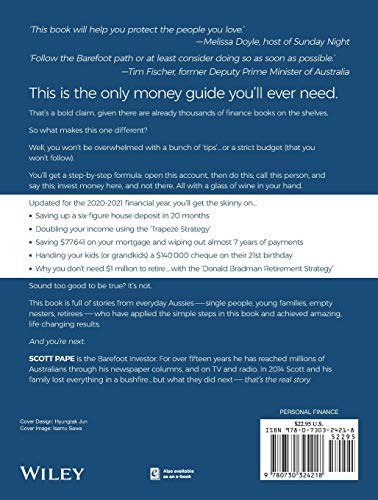

The Barefoot Investor [Pape, Scott] on desertcart.com. *FREE* shipping on qualifying offers. The Barefoot Investor Review: Information - Good read and info Review: Understandable and clear financial advice - My brother put me on to this book and I am greatful that he did. Scott breaks down the confusion and technical jargon around financial planning and puts it all into very easy steps that any lay person can follow. Just taking the first few steps of reviewing my current habits and setting up the buckets approach has really made me feel so much more in control of my finances and far less stressed about my future. This really is an easy book to follow and written with good wit and texture which makes it an entertaining read. I would highly recommend just starting it as I did and you will soon be at the last page with confidence in your new financial plan.

| Best Sellers Rank | #2,454,619 in Books ( See Top 100 in Books ) #633 in Personal Finance (Books) #2,657 in Business & Finance |

| Customer Reviews | 4.7 4.7 out of 5 stars (8,003) |

| Dimensions | 7.06 x 0.67 x 9.06 inches |

| Edition | 1st |

| ISBN-10 | 0730324214 |

| ISBN-13 | 978-0730324218 |

| Item Weight | 15.7 ounces |

| Language | English |

| Print length | 296 pages |

| Publication date | November 14, 2016 |

| Publisher | Wiley |

F**H

Information

Good read and info

T**M

Understandable and clear financial advice

My brother put me on to this book and I am greatful that he did. Scott breaks down the confusion and technical jargon around financial planning and puts it all into very easy steps that any lay person can follow. Just taking the first few steps of reviewing my current habits and setting up the buckets approach has really made me feel so much more in control of my finances and far less stressed about my future. This really is an easy book to follow and written with good wit and texture which makes it an entertaining read. I would highly recommend just starting it as I did and you will soon be at the last page with confidence in your new financial plan.

N**W

no nonsense self help financial book with step by step guide

I have heard a lot about barefoot investor and have been part of the local facebook group for a while. I happen to be travelling and had about 10 hours to kill so decided to start reading Scott’s book, to see what the fuss is all about. I have read 20+ financial related topics, and from now on, this book will be the number 1 book i will recommend to all my friends and colleagues, who needed help in understand how money works, as well as sorting out their personal financial goal. Book is very easy to read, with no nonsense step by step guides, which should be fairly easy to follow for most people. Well done Scott on writing this book. I finally understand why people rave about your book now.

I**A

Nice, prescriptive model for financial success

I like this a lot with some caveats. This is a good starting point and much of this is a cut down (prescriptive) version of the richest man in babylon. I do wish that this book had covered off the difference between good debt and bad debt - instead of implying all investment debt is bad. Good book.

J**R

An Australian Dave Ramsey

This book was really fun to read. Pape is consistently interesting and engaging. It was not particularly life-changing for me: most of his advice concerns things I've already been doing for years. But there are many people out there for whom this book is exactly what they need. Pape is like an Australian Dave Ramsey . The book is written in very Australian language, and the situations he discusses are usually specific to Australia. Yet many of Pape's principles and steps are identical to Ramsey: both emphasise paying off debt quickly, but not before you set up an emergency fund (as Ramsey calls it) or "Mojo" (Pape's term). Being Australian, Pape is a lot more laid back, and, unlike Ramsey, does not push a strict budgetary system. One of the things that comes through in this book is that Pape is a man of integrity and compassion - he has a genuine concern for those who feel trapped by debt or a fearful for their financial future. This is an excellent book, and Pape appears to be an excellent mentor.

M**8

Highly recommended for financial advice

Highly recommended - looking forward to reading this

M**G

A must read for your young adult children

After reading The Barefoot Investor I immediately purchased 3 more copies as gifts for my young adult children. Much of what I read in the book aligned with the common sense approach to money management that I have lived (I am now 60), however the author's easy to follow and fun approach via a series of explicit steps is something I am sure my kids will enjoy following. Not to mention, hearing from an expert closer to their age is likely to get more traction than sage advice from their father. The book is an easy and entertaining read. The occasional testimonials throughout the book underline the practical results that can come from following the steps, although there is a small risk that to some readers these might be a little annoying. If so, then just skip over them. Ultimately, what an individual gets out of the book will come down to their willingness to follow the low risk approach that will eventually result in financial independence. This is a must read for anyone that desires financial independence, whether you are just starting out or heading towards the end of your working life. Even if you are highly financially literate, I am sure there will be something positive that you will take from this book.

A**R

A good read and good advice.

Scott Pape is a legend when it comes to finance. I read the book with interest and was very proud when I read the last chapter ( I am retired) and found that I was in the exact position that Scott said I should be in retirement. I have property investments fully owned, a share portfolio with no debt and superannuation giving my wife and I a good cash flow in our retirement. Unknowingly I had followed Scott's financial plan through my working life and it has certainly paid off for me. He mentions common sense in financial affairs and this is very true. We are fully self funded, getting no payment from the Government and if everybody followed Scott's plan we would have a far less reliance on Government benefits and the country would be in a far better state. I always read Scott's column in the Sun Herald every weekend, it is good reading and good advice. A great book every one should read and follow.

B**I

J'ai entendu parler de Scott Pape par un podcast appelé "Mme Fauchée", elle en faisait un résumé et je l'ai trouvé tellement intéressant que j'ai acheté l'audio (impossible d'avoir le livre en France). Bien que Scott Pape soit australien et que certaines de ses idées soient pour le système australien, il est un génie quand aux idées de bien gérer son argent! Je regrette n'avoir pas eu son livre plus tôt

E**Y

Great Financial Handbook. Doesn't just advise on what to do, but walks you through HOW to do it. Great for people who are combining finances.

J**E

Easy explained. But seriously, those who cannot save money with AU$90,000 per year need something else than a simple book. Most of the advices are not possible to follow if you don't earn that much.

V**.

a very interesting book to read

N**A

Scott writes the book from his heart giving valuable advice. Very import read for anyone who needs to take control of its finance. Totally recommend this book.

Trustpilot

5 days ago

1 week ago